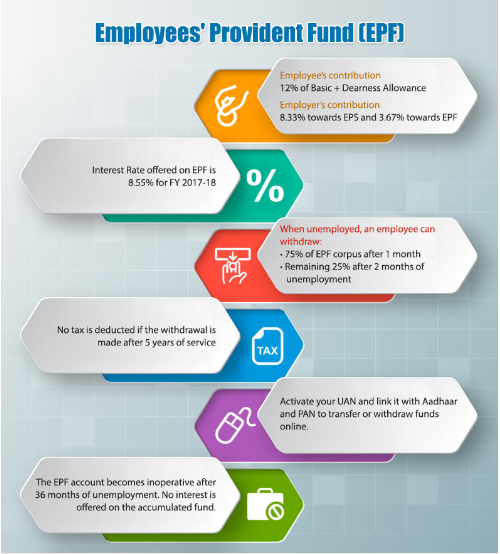

Which payments are subject to EPF contribution and which are exempted. Even if the employees salary exceeds Rs 15000 the employer.

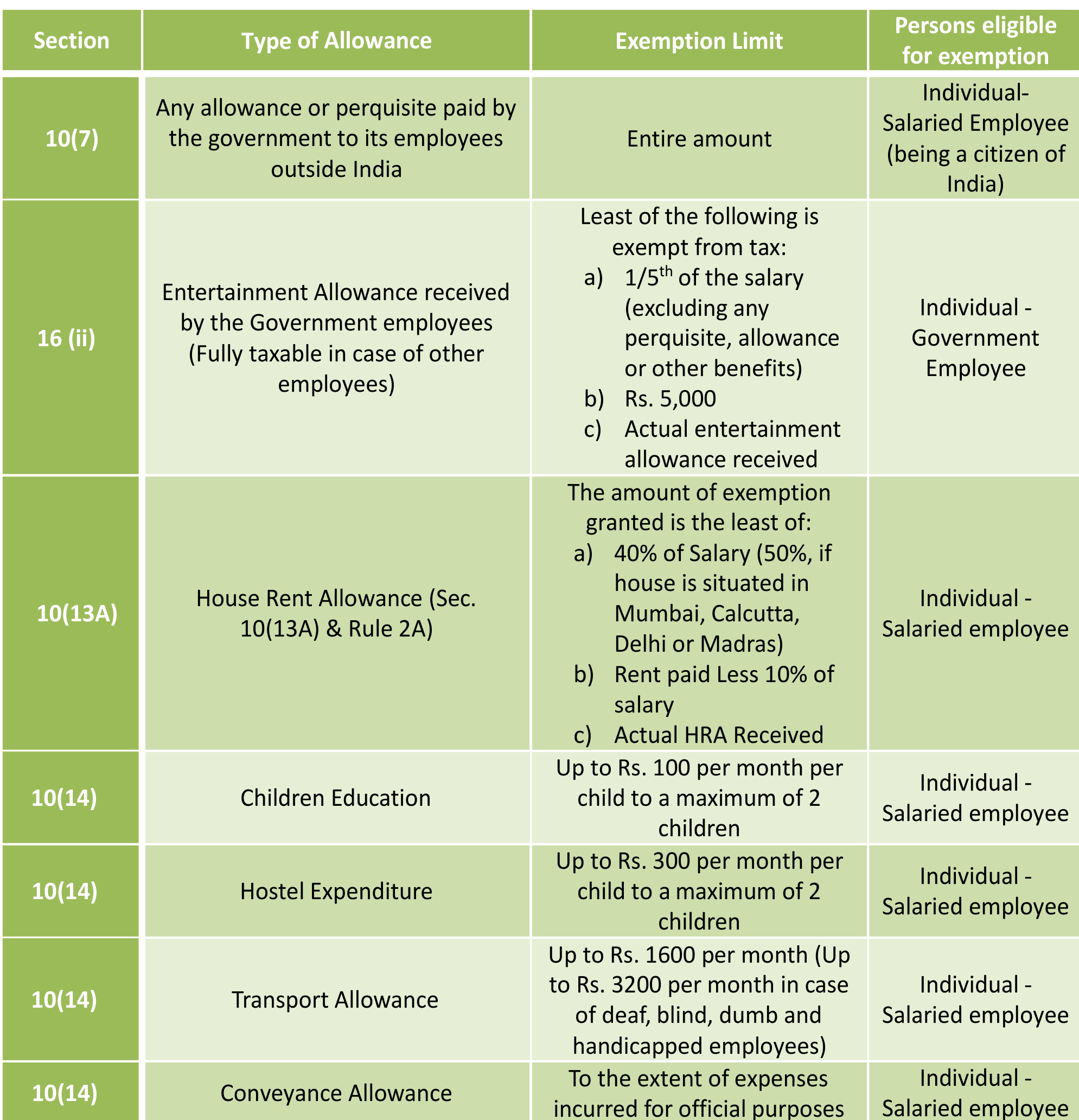

Special Allowances In India Under Income Tax Return Itr Taxhelpdesk

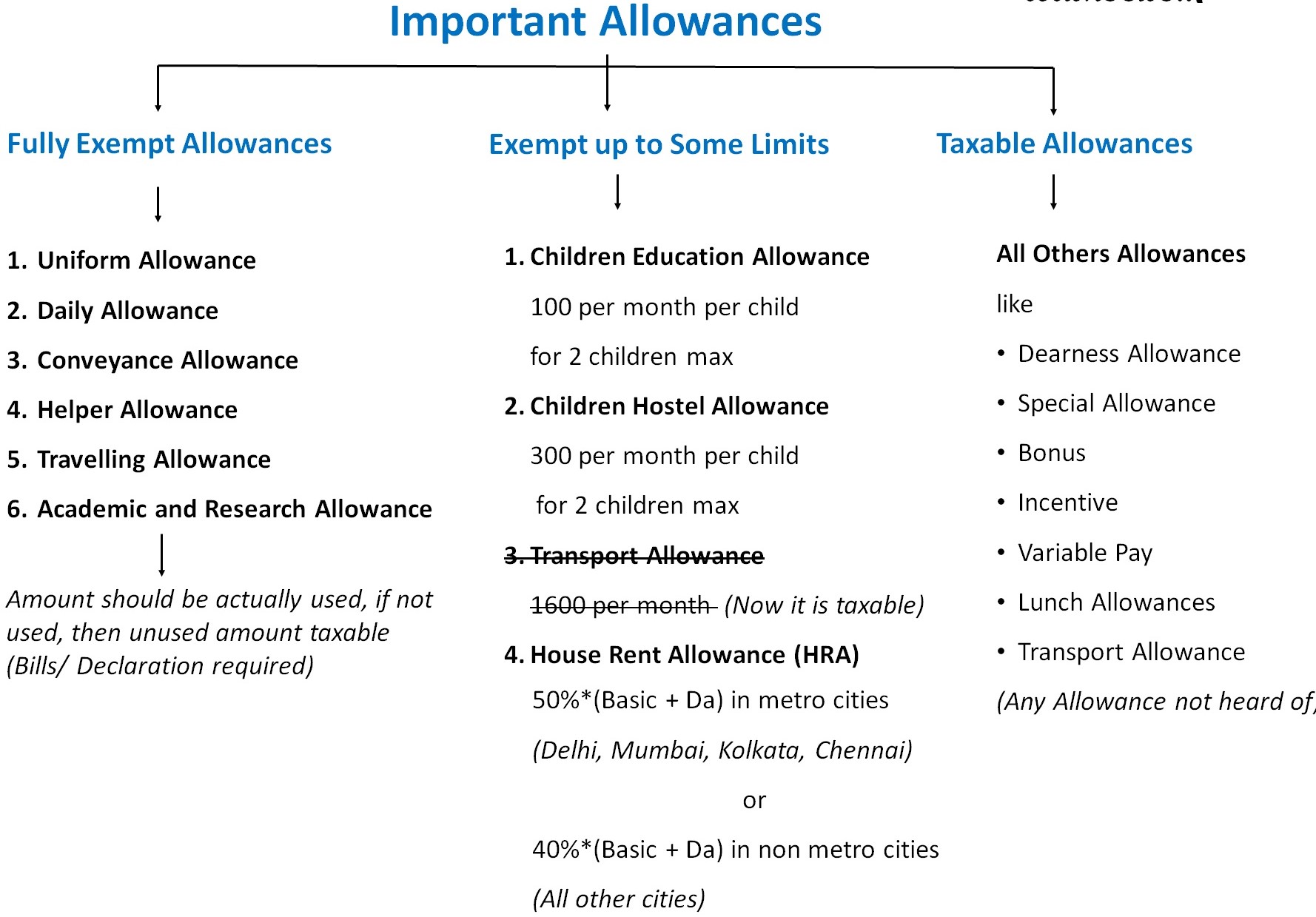

Allowances except a few see below Commissions.

. Before 5 Years of Service. If the withdrawal amount is less than INR 50000 then no TDS is cut. Wages for half day leave.

Full withdrawal from the EPF account is allowed if an employee has left hisher job and has not joined any other new job after two months. The Apex Courts ruling will warrant increased PF contributions by employers for employees whose basic wages are lower than Rs 15000 per month. FY 2018-19 no such separate transport allowance is permitted Physically challenged.

He will continue to be a member even when his pay. LIST OF PERFORMANCE OF EXEMPTED ESTABLISHMENTS. Last updated.

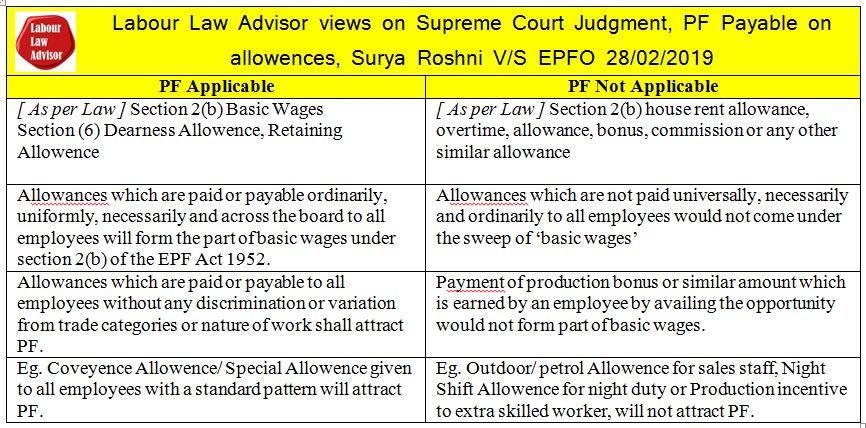

Allowances which are linked to any incentive for production resulting in greater output by an. Section 43 1 EPF Act 1991 Determining Obligation To Contribute These are the three main elements which determine the obligation to contribute to EPF. It excludes dearness allowance houserent allowance overtime allowance bonus commission or any other similar allowance payable to the employee in respect of his.

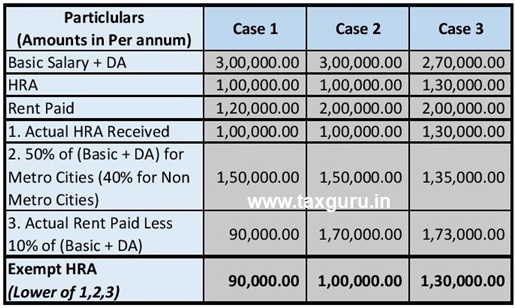

Exemption amount of 70 of such allowance or 10000 per month whichever is lower. Pls anybody tell me which allwances is exempt from epf - Others. Allowances Exempt From Tax For Salaried Person Most Useful Planmoneytax Salary Ctc Components And What Is Taxable Financial Planning Investing Income Tax Hra Lta Epf Nps.

The USP of the Employees Provident. WHAT THE EPF ACT SAYS EPF Act 1952 Section 2bii b basic wages means all emoluments which are earned by an employee while on duty or on leave or on holidays with wages in either. Employees who have an income lesser than 15000 are supposed to mandatorily enlist in the EPF scheme.

EPF withdrawals before five years of continuous service attract TDS. 03 Mar 2021 EPF members in the private and non-pensionable public sectors contribute to their retirement savings through monthly salary deductions by their. Wages for maternity leave.

Tax Benefits Maturity proceeds from EPFVPF are tax exempted only if. 1If an employee completes 5 years of Service then there is no TDS for. Pls anybody tell me which allwances is exempt from epf - Others.

Principles laid down for allowances to be excluded Allowances which are variable in nature. Special allowance. 2019 Deloitte Touche Tohmatsu India LLP Provident Fund applicability on allowances 7 The PF.

The employee pays about 12 of his income while the employer. Employees are in enjoyment of benefits in the nature of Provident Fund Pension or. National Labour Conference of Labour Ministers Labour Secretaries of states UTs - 25th 26th August 2022 - Tirupati.

Tax exemption on EPF Withdrawal For the below cases there is no TDS Tax deduction at source. Where exemption is granted to an establishment as a whole under Section 17 1 b of the Act. Allowance except travelling allowance is included in the definition of wages under the EPF Act.

However as the word is broad enough to include payments for food clothes. The employees who are drawing the basic wages and dearness allowance up to Rs15 000- are alone eligible to become a member. For the previous financial years EPF has fixed the rate at 875 which is only slightly greater than PPF rate.

The employers monthly contribution is restricted to a maximum amount of Rs 1800. Tax exemption on EPF Withdrawal For the below cases there is no TDS Tax deduction at source. Wages for study leave.

Payments Subject to EPF Contribution In general all monetary payments that are meant to be.

All About Allowances Income Tax Exemption Ca Rajput Jain

Tax Benefits On Epf Employer Employee Contribution Impact Of Withdrawal Before 5 Years Saving For Retirement Facts Money Today

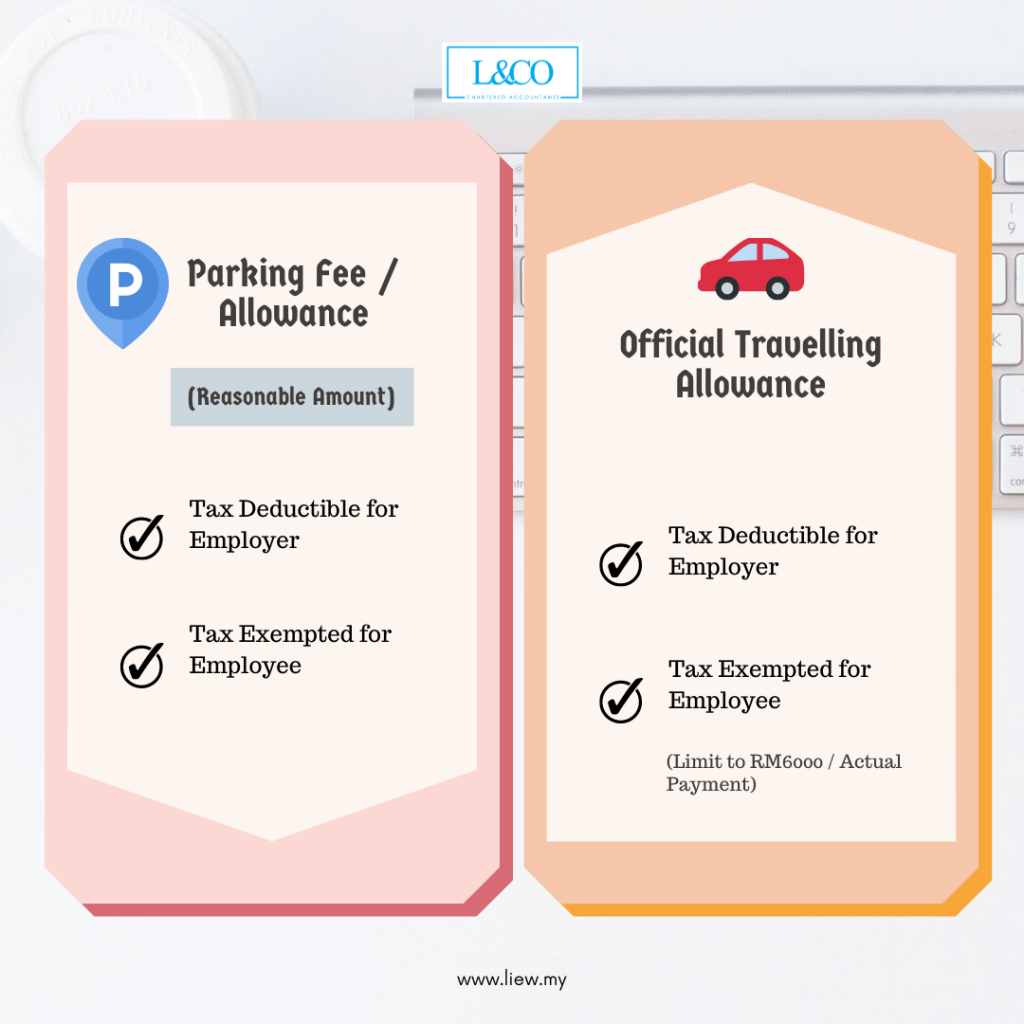

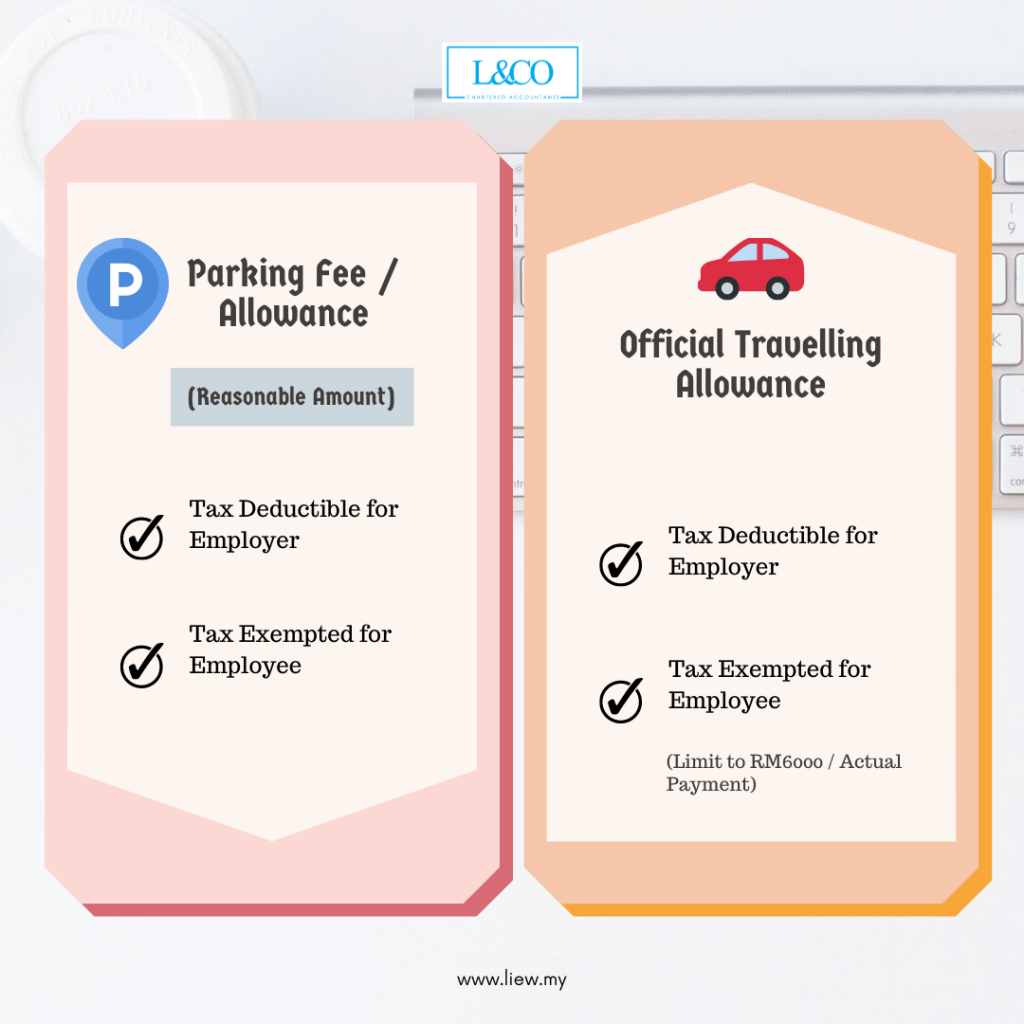

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

Which Allowance Is Exempt From Epf Madalynngwf

All About Allowances Income Tax Exemption Ca Rajput Jain

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions

Which Allowance Is Exempt From Epf Madalynngwf

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

All About Allowances Income Tax Exemption Ca Rajput Jain

Allowances Exempt From Tax For Salaried Person Most Useful Planmoneytax

Supreme Court Epf Judgement 2019 Labour Law Advisor

What Is Form Ea Part 2 Defining The Perquisites

All About Allowances Income Tax Exemption Ca Rajput Jain

What Payments Are Subject To Epf Donovan Ho

Salary Segments That Can Reduce Employees Tax Liabilities Sag Infotech Salary Segmentation Tuition Fees

Download Gratuity Calculator India Excel Template Msofficegeek Payroll Template Excel Templates Templates

10 Types Of Employee Payments Apart From Salary That Businesses Need To Pay Cpf For Dollarsandsense Business

Do You Need To Make Epf Payments For Bonuses And Cash Allowances In Malaysia Althr Blog

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs